Managing personal finances effectively is a crucial aspect of achieving financial stability and reaching your long-term goals. Yet, for many, the task can feel overwhelming without a structured approach. Enter the Monthly Finance Planner—a simple yet powerful tool designed to help you take control of your finances and build a solid financial foundation. In this article, we will explore the benefits of using a Monthly Finance Planner for personal use, how to use it effectively.

Why Use a Monthly Finance Planner?

A Monthly Finance Planner is more than just a budgeting tool; it’s a comprehensive approach to managing your money. Here’s why incorporating one into your financial routine can make a significant difference:

Organization and Clarity

By laying out all your financial details in one place, a planner helps you see the bigger picture. You’ll gain clarity on your income, expenses and investments, making it easier to manage your finances effectively.

Improved Budgeting

A planner helps you track your spending patterns and adjust your budget accordingly. By reviewing your monthly expenses, you can identify areas where you might be overspending and make necessary changes.

Goal Setting and Tracking

Setting financial goals is essential but tracking is equally important. A monthly planner allows you to set short-term and long-term goals and monitor your progress towards achieving them.

How to Use Your Monthly Finance Planner effectively

To get the most out of your Monthly Finance Planner, follow these steps:

Gather Your Financial Information

Start by collecting all relevant financial documents. This will give you a comprehensive view of your financial situation.

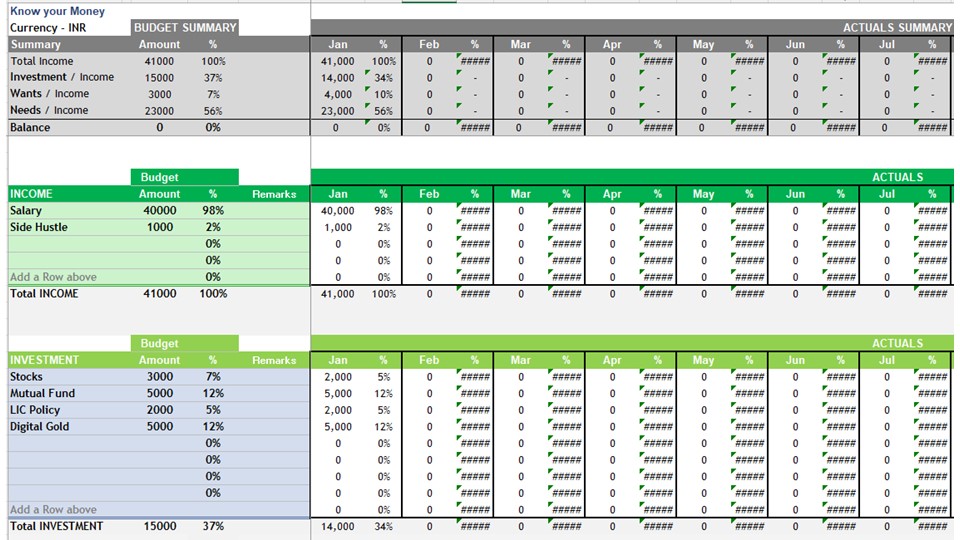

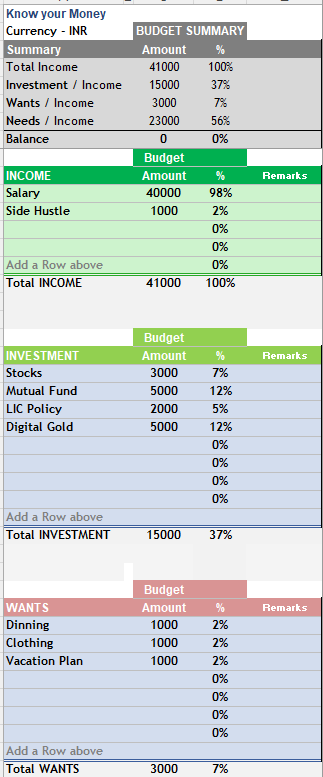

Budget your Money flow

Based on your income and spendings, create a budget that allocates funds to essential categories. This will help you understand how to allocate your money on monthly basis.

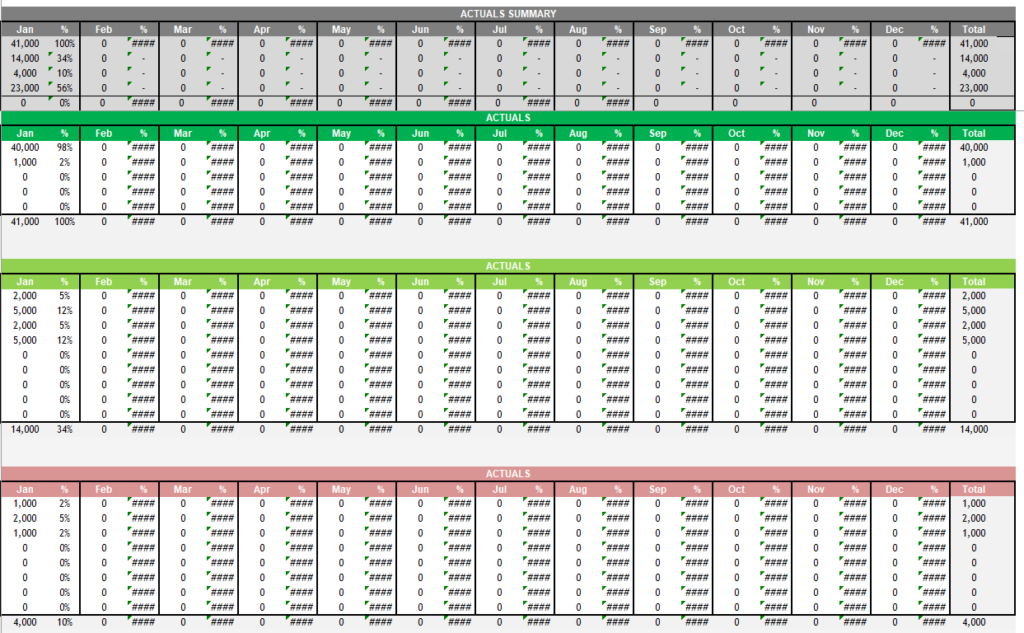

Track your money flow

Record all sources of income, Investments, Wants and Needs on monthly basis. Be realistic about your monthly Income and spendings and make adjustments as needed on monthly basis.

Monitor and Adjust

Regularly review your planner to track your progress and make adjustments. If you notice that you’re consistently overspending in a particular category, revise your budget accordingly.

Review and Reflect

At the end of each month, take time to review your financial performance. Reflect on what worked well and what could be improved. Use this insight to refine your budgeting and financial strategies.

Tips for Maintaining Financial Discipline

Using a Monthly Finance Planner is just the beginning. To maintain financial discipline and achieve your goals, consider the following tips:

Be Consistent

Regularly update your planner and review your financial status. Consistency is key to staying on track and making informed decisions.

Seek Professional Advice

If you’re unsure about your financial planning, consider consulting a financial advisor. They can provide personalized guidance and help you develop a robust financial strategy.

Conclusion

Monthly Finance Planner is an invaluable tool for anyone looking to gain control over their finances. By organizing your finances, you’ll be better equipped to make informed decisions, plan for the future.

Disclaimer

The Monthly Finance Planner is a basic tool created on personal experience to help manage your finances. It is almost automated but also editable. A basic MS Excel knowledge is required to operate this tool. It does not promise any financial gain and expert opinion is advisable if you are very new to Financial Planning.